Customer reviews on Credit Karma have the potential to either attract or drive away customers from a specific financial product or service. Suffice it to say, they also play a major role for consumers looking to decide whether or not to trust a provider with their finances.

A 2019 report from Edelman found that financial services have the lowest percentage of trust across multiple industries at 57 percent, which is why consumers need social proof to be the deciding factor for their purchase decisions. This is where review sites like Credit Karma come in to play.

Its reviews section features customer feedback across multiple categories ranging from credit cards and personal loan products to credit unions, home equity, and auto insurance. These types of feedback are heavily favored by 42 percent of consumers, who prefer to use third-party reviews to find out if a financial institution is trustworthy.

However, they also have benefits for any banks, credit card companies, or other financial services that have products on Credit Karma. Reading the opinions of customers with your products provides valuable insights that can improve the customer experience and increase revenue.

How to Sign Up for Credit Karma

Anyone can sign up for Credit Karma provided that they meet the following requirements:

- They are 18 years of age or older.

- They have a valid U.S. Social Security number

- The information provided during the signup process and in the future is “true, accurate, current, and complete.”

- They will only use the account for themselves.

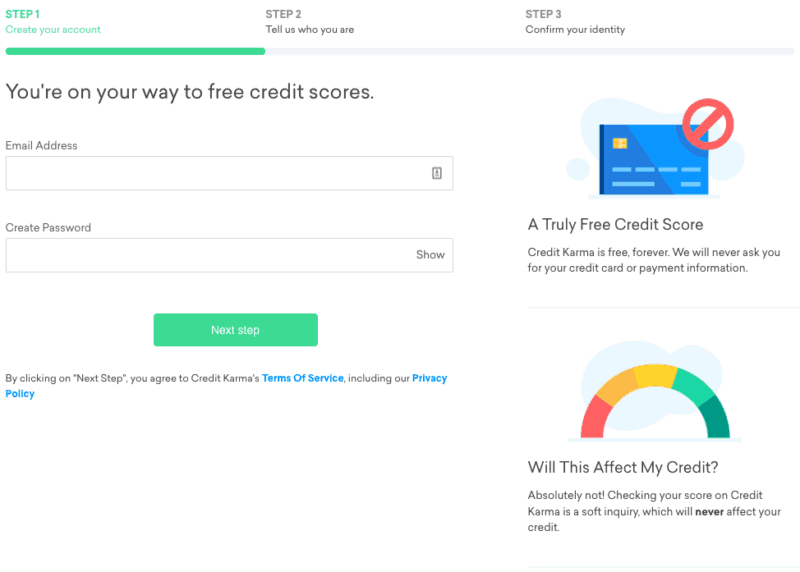

Those who are eligible can begin the signup process by clicking the “Sign up for free” link on the top-right corner of the Credit Karma home page. From there:

- Create the account. The user will need to enter a valid email address and password before moving on to the next step.

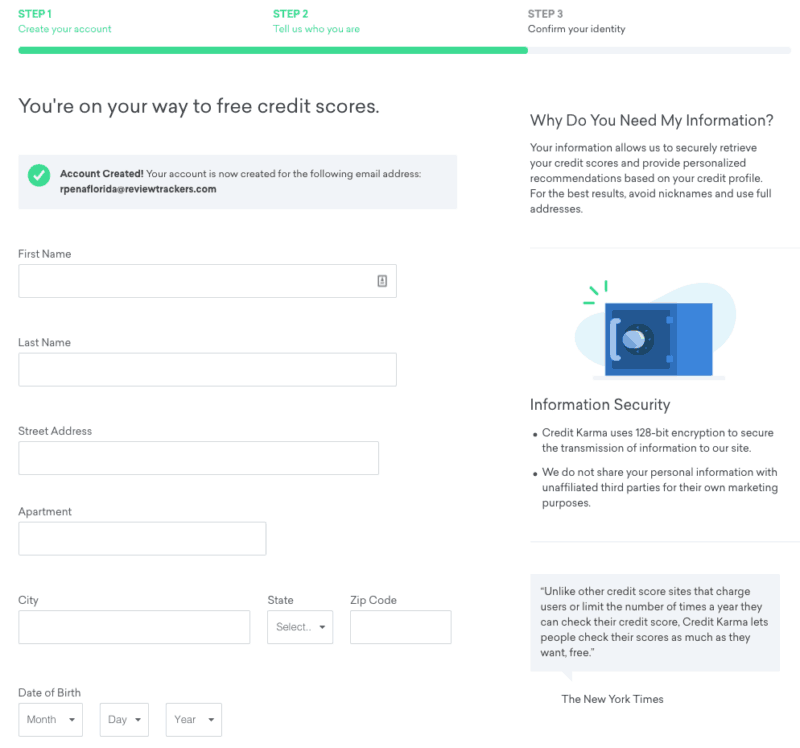

- Provide additional information. In order to retrieve their credit score and “provide personalized information,” Credit Karma will ask the user for more personal information. They also have to mark a checkbox that authorizes Credit Karma to retrieve your credit scores. The information provided in this step includes:

- First and last name

- Address (including city, state, and ZIP code)

- Date of birth

- The last four digits of their Social Security Number

- Verify user identity. By default Credit Karma will ask a few questions that will confirm the user’s identity. If they can’t complete this process, they can choose to upload a copy of their driver’s license or state ID.

A Closer Look at Credit Karma Reviews

Those that have a financial product or service listed on Credit Karma can respond to the reviews posted on its listing page. However, a business account for any financial service isn’t available on Credit Karma’s website.

What you can do instead is sign up as a regular “member” and choose your business or product name as your user name.

To respond to Credit Karma reviews on the product page:

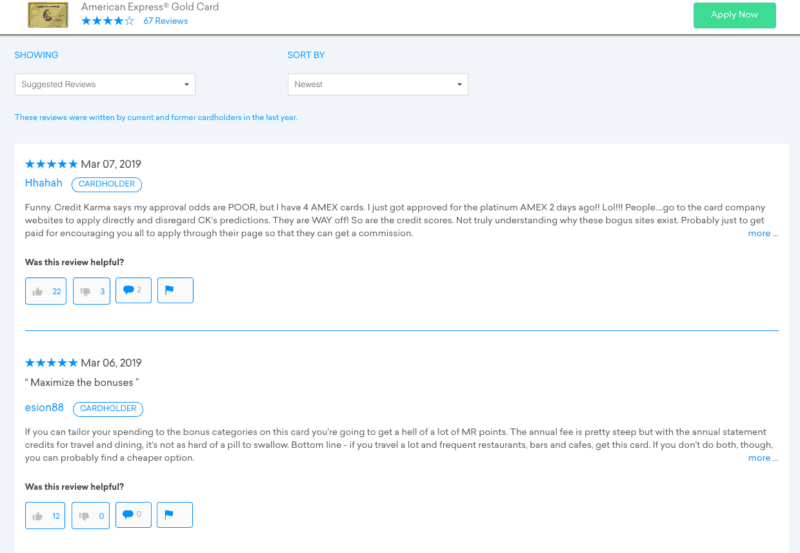

- Find the review. Customer reviews are located beneath the product details. You can choose to filter them by recency, popularity, or rating. You can also choose to see all reviews or a small sample of “Suggested Reviews.”

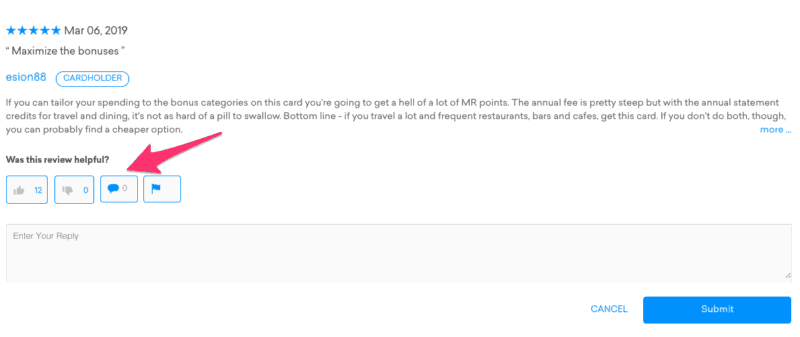

- Write your response. When you find the review in question, click on the speech bubble icon beneath the review. You should see a large text box where you can write a reply. Click the submit button when you’re done.

Why Are Credit Karma Reviews Important?

In the face of negative reviews and social media criticism, your financial services organization may feel like rejecting online reviews altogether. However, reviews and other forms of user-generated content and customer feedback can actually be harnessed as a tool for building social proof and consumer trust.

“Most leading companies are tracking brand sentiment and social media conversation,” says Troy Janisch, Director of Social Intelligence for U.S. Bank.

“What they are overlooking are review sites such as Yelp, mobile app stores, and social media review pages. People write reviews most often because they have a really bad or a really good experience. Companies often approach review sites solely as a customer service channel, but that’s only half of the opportunity.”

In today’s competitive financial services landscape, the most successful brands have learned to use online reviews and customer feedback in order to drive search engine performance, gain visibility in the eyes of ready-to-buy consumers, and boost consumer engagement levels.